2024: A Bold Scenario

Forget those mediocre 5-10% equity market forecasts. What if we get a recession, a liquidity boom, and another blockbuster year for risky assets?

The end of the year is approaching, which means that the so-called ‘top investors’ traditionally are making their predictions for the coming year. I anticipate that the average expected return on stocks from these forecasters will fall somewhere between five and ten percent, as is almost always the case. I must emphasize, however, that the likelihood of these forecasters being wrong is quite significant. More on that later.

An Outlier Scenario

It is much more exciting, and often more meaningful, to consider what the outliers for the coming year might be. A market scenario that few investors are currently considering, but one that should not be ruled out. Let’s give it a try.

The unexpected Recession

Nearly every investor currently prices out the likelihood of a (US) recession. However, this is not entirely justified. The picture painted by macro indicators that have historically been good predictors of recessions is mixed. One notable factor is the recovery of the US real estate market. The fact that investments, which saw a recession-like decline in the first half of the year, are now rebounding could suggest that the worst may be behind us.

Nevertheless, historically, it takes about two years for a Fed tightening cycle to show up in macroeconomic figures. We are not there yet. It seems overly optimistic for markets to expect no recession at all, so a recession is the potential ‘wild card’ scenario for 2024.

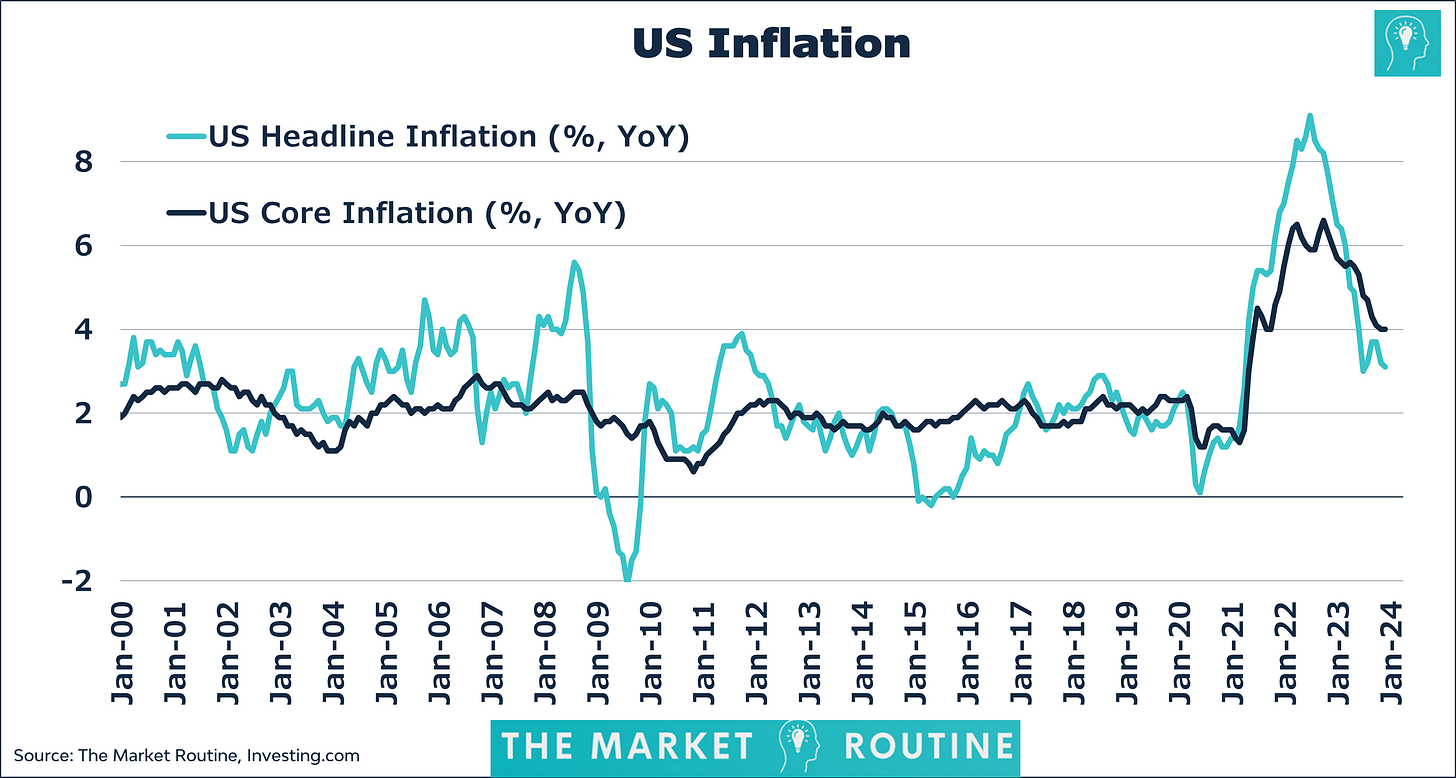

Deflation

If a US recession materializes, it will likely be accompanied by deflation, which few investors are currently considering. Even in the case of a significant slowdown, but not a recession, price declines should not be ruled out. A close look at inflation charts will reveal that inflation is declining even faster than it rose. With rising unemployment and falling consumer spending, the likelihood of lower prices is significant. In Europe, a deflationary scenario is even more plausible, given that growth is already practically at a standstill.

At least Eight Fed Rate Cuts

An unexpected recession with deflation is something that many investors fear. Historically, it has been a dangerous combination often accompanied by a significant decline in stock prices.

But whether this will be the case this time depends (nearly) entirely on central banks. Since the Great Financial Crisis, central banks have consistently expanded their balance sheets during each crisis. Quantitative Easing is a tool that has been readily employed, and the ECB already has the next QE tool – with even more flexibility – already in place should things go awry.

I expect that the Federal Reserve and ECB will be hesitant about using QE, even if a recession becomes a reality, simply because of the significant damage to their reputations in recent years related to inflation spiraling out of control. However, they will have ample room to cut rates because interest rates are relatively high. In this scenario, I expect at least eight quarter-point rate cuts, compared to the market’s six and the Fed’s three.

S&P 500 Index hits 6,000

Now it gets really interesting. If central banks cut rates aggressively, I foresee that markets will anticipate QE quickly. In any case, the chances are high that liquidity will increase. An S&P 500 Index of 6,000 is not out of the question in the case of a major shift in central bank policy.

Sovereign Downgrades

I also expect governments that are already refusing to cut spending while the economy is doing reasonably well, especially in the United States, will create even larger budget deficits. At least one of the major credit rating agencies, probably Moody’s, will likely downgrade the United States and/or China. This will further pressure central banks to keep interest rates relatively low.

The Great Rebalancing

These sovereign downgrades will add to the growing unease about the sustainability of the massive pile of long-term debt. Central banks, cutting rates massively, will push interest rates down one last time, so 2024 could be a good year for bonds, but it will be over after that. This raises the question of how much added value government bonds will have in a diversified portfolio. Well, probably less than before, with gold as the primary replacement. But more on that soon.