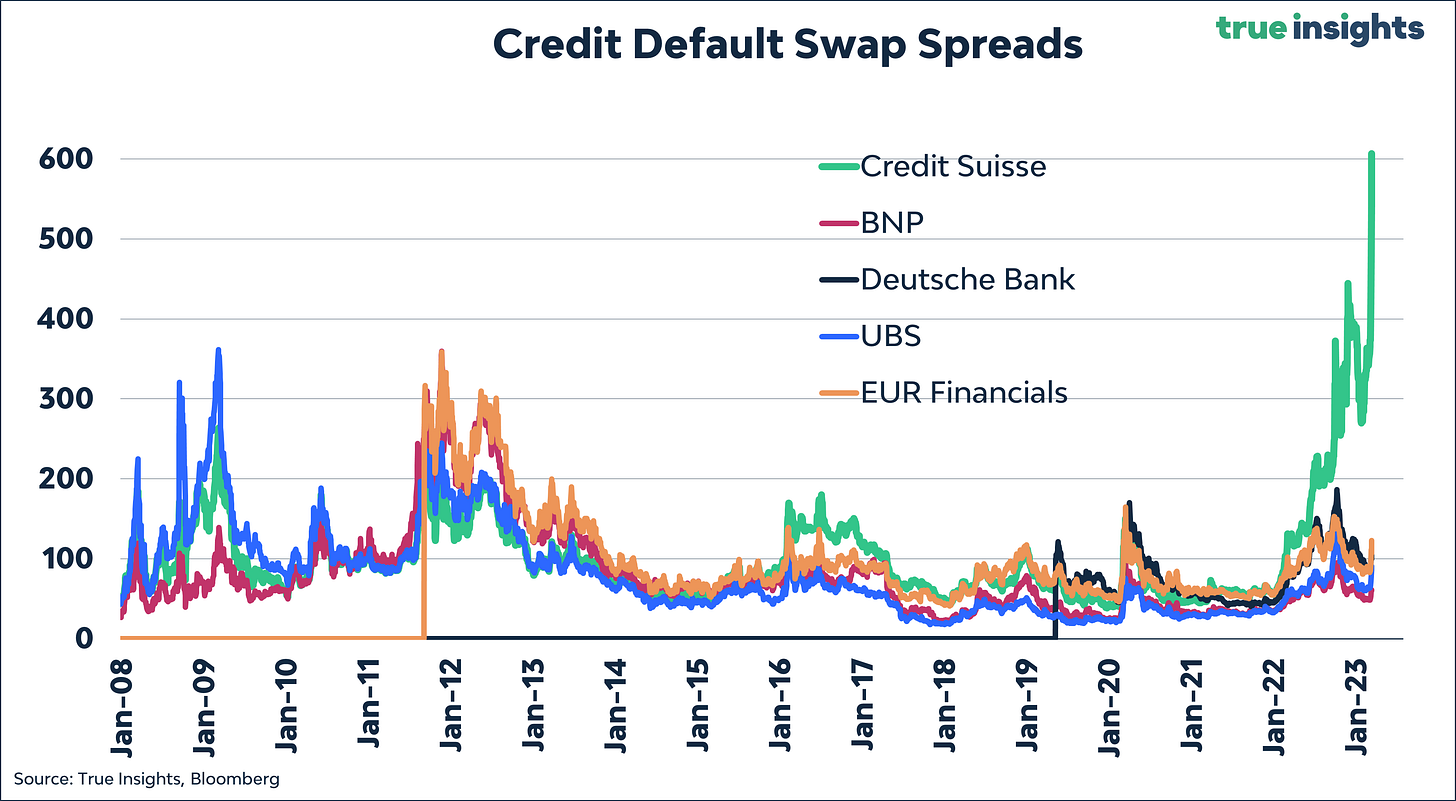

A lot depends on what happens to this Credit Suisse chart

Likely deposits will keep fleeing, reducing the odds of survival for the Global Systemically Important Bank

A very brief post on Credit Suisse now that the unfolding banking crisis has made it across the Atlantic.

While the root of their despair is quite different, Credit Suisse shares a couple of deeply-worrying characteristics with Silicon Valley Bank: lack of trust and deposit outflows. This means that while the liquidity position of Credit Suisse is much better than that of SVB, or at least it used to be, and its interest rate sensitivity is much lower - SVB’s collapse had a lot to do with having to realize losses on longer-maturity bonds that were trading at a big loss because of spiking interest rates - the company could find itself in the same awkward position soon.

As you can tell from the chart above, Credit Suisse deposits plummeted in the final quarter of last year. Company deposits fell by a whopping 140 billion Swiss Franc or 37%. And even though Credit Suisse has stated that it had deposit inflows since the start of the year, this will likely reverse. Which compliance officer will allow you to park your money or do business at an institution that could be on the brink of collapse? Learning how much Credit Suisse’s deposits have suffered - we already know its equity capital went down the drain - during the latest episode of anxiety will be key.

I get a bit of a feeling we may be beyond the point of no return already. A cautious portfolio positioning is warranted.

Some relief: CreditSuisse’s stock trading in the US is up nearly 20% since the Swiss central bank (SNB) stated it stands ready to provide liquidity IF necessary. Most likely, this will be the case.

Next up is the ECB. I expect the central bank will hike, but only by 25 basis points, to move back to 50 bps hikes when the banking risks are contained.