Delay does NOT equal Cancellation!

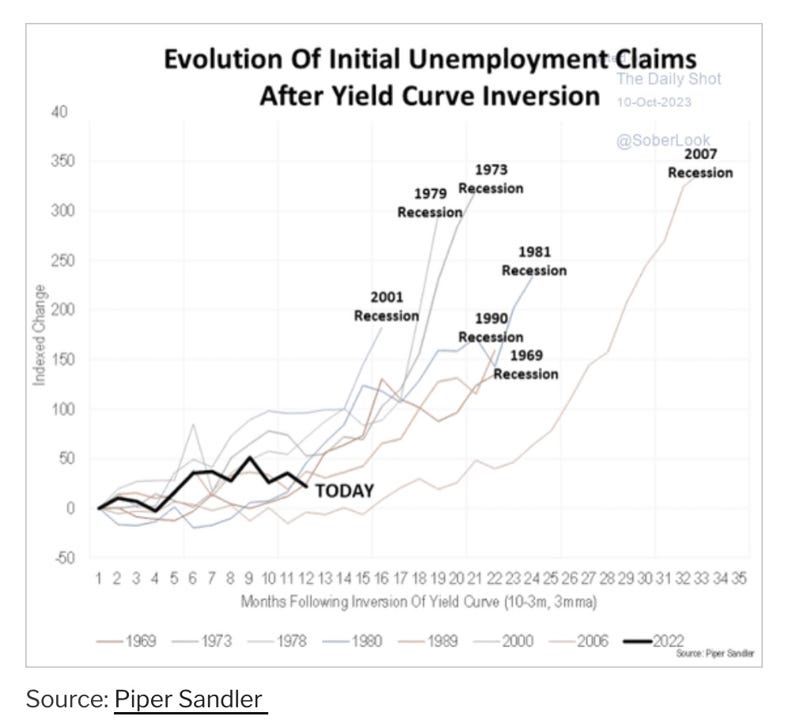

The worst for the US labor market has yet to come; this is no different from the past.

The graph below is currently trending on social media, and not without reason. It reveals that the real pain in the US labor market only emerges when the yield curve has been inverted for over a year. There is a significant likelihood that investors are, once again, prematurely celebrating a soft landing.

Get ready for the spike

The graph from Piper Sandler shows initial jobless claims as a gauge for the US labor market. This year, initial unemployment claims have fooled economists, the Federal Reserve, and investors three times already. On three occasions, it seemed as if a structural increase was underway, only to sharply decline afterward. However, the graph above suggests this pattern is not as unusual as it may seem. It takes some time for the Federal Reserve's tightening cycle - which typically culminates in an inverted yield curve - to become apparent in reported macroeconomic figures, including the US labor market.

History Rhymes

The chart below may illustrate this even more effectively. It shows the cumulative increase in US unemployment against the cumulative rise in interest rates during the most significant Federal Reserve tightening cycles since the early '70s. Keep in mind that I have shifted the cumulative Fed Target Rate increase forward two years.

The chart clearly shows what happened to unemployment two years in the tightening cycle. On average, the unemployment rate increased by around three percentage points. There is one exception, the 1994-1995 tightening cycle (depicted here two years ahead in 1996-1997), during which unemployment did not rise at all. Not coincidentally, this period represents a Fed tightening cycle that did NOT accumulate into a recession.

Thriving on Hopium?

For the soft landing aficionados, the 1994-1995 Fed tightening cycle brings hope. However, historically, the odds are high that the real weakening of the US labor market is yet to arrive. With fragile consumer confidence and the end of COVID-related excess savings, this could lead to a decline in consumer spending. When this happens, a recession is never far away!