Dr. Copper: Still Relevant?

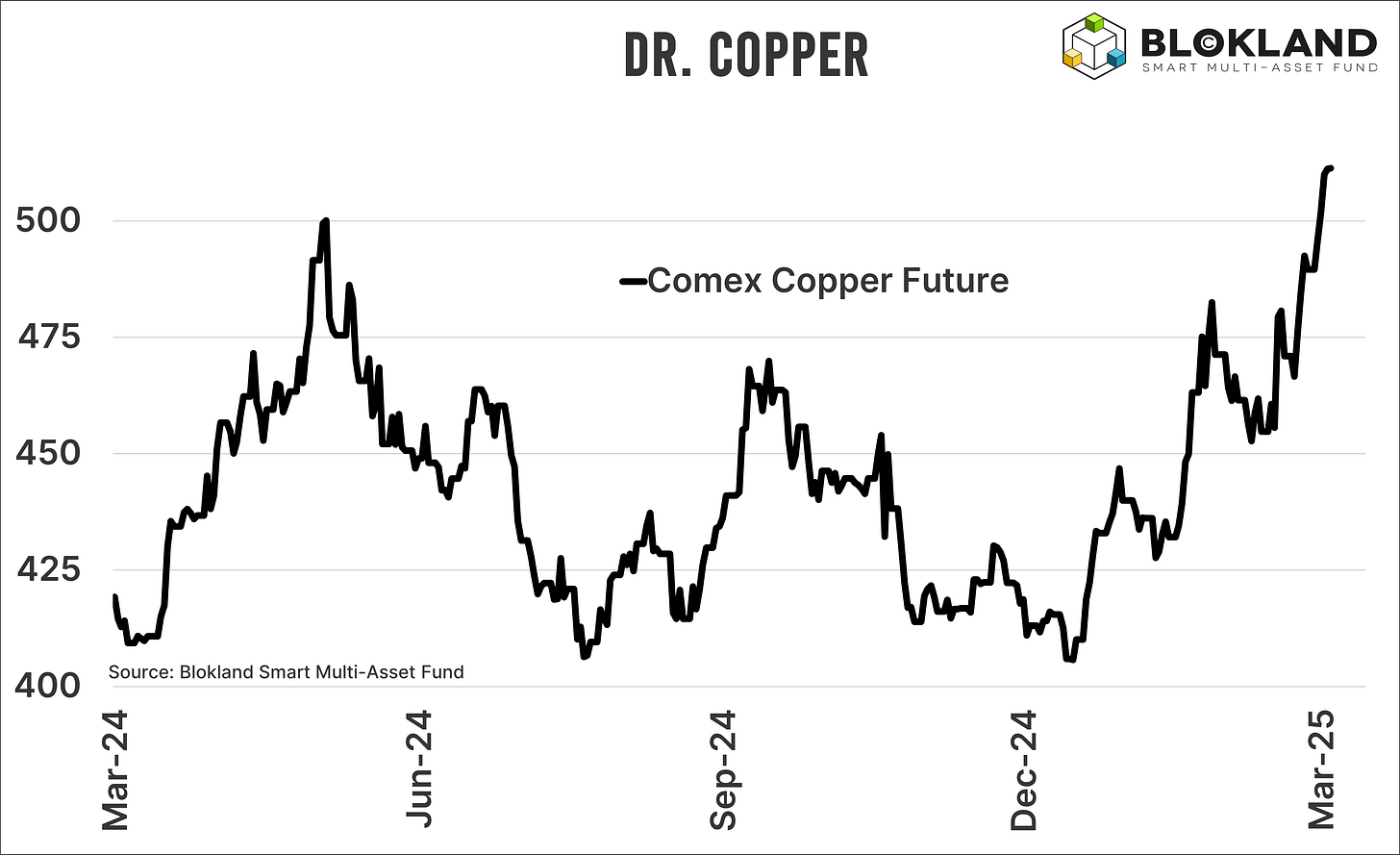

Copper is up a whopping 26% this year. Does that mean a recession is off the table?

Dr. Copper: Still Relevant?

Since the start of the year, copper prices have surged 26%. So, that must mean Dr. Copper is signaling clear skies ahead. No recession in sight, right?

Copper Is Everywhere

Dr. Copper has long been viewed as a reliable economic barometer. That’s because copper is used in virtually everything, from housing and construction to electric vehicles and consumer electronics. It’s also found in rocket engines, desalination plants, whisky distilleries, and musical instruments. Given its broad application, it makes sense that copper demand would reflect the health of the economy.

Historically, the data supports this. Numerous studies have shown a positive correlation between copper prices and (future) GDP growth, allowing flexibility in how the numbers are analyzed.

With that in mind, a 26% rally should suggest a recession isn’t looming anytime soon.

But Signals Are Getting Murkier

If only it were that simple. Over time, the copper-economy relationship has become more muddled, especially across the Atlantic. In the U.S., the connection between growth and copper has arguably broken down altogether.

That’s mainly due to the return of Trump’s trade wars. His unpredictable stance on import tariffs now has an outsized influence on metals markets. And unlike oil, the U.S. still relies heavily on imported copper.

Recently, Trump signed a decree labeling copper as a critical input for both national security and economic resilience. The Department of Commerce has been tasked with assessing whether copper imports threaten U.S. security, a process that could very well result in new import tariffs.

This “copper sword of Damocles” now hangs over the market, distorting price signals and reducing the role of traditional supply and demand.

Speculation and Arbitrage Are Driving Prices

For speculators, the prospect of tariffs is a dream scenario. If imposed, tariffs would make imported copper significantly more expensive in the U.S., creating immediate pricing inefficiencies.

As a result, traders have ramped up arbitrage strategies, buying copper where it’s cheaper (London) and shipping it to the U.S. According to analysts at Vontobel, the price spread between the London Metal Exchange (LME) and the U.S. COMEX has ballooned from USD 240 per ton at the start of Trump’s second term to around USD 700 today.

That represents a 5% premium (relative to the current price per ton), suggesting a meaningful portion of the rally is tariff-driven, not necessarily economically driven.

And Then There’s China

Of course, China remains central to the copper story. This is not only because of its vast housing sector but also because of its booming electric vehicle (EV) industry.

As Bloomberg recently noted: “Cheap Chinese Cars Are Taking Over Roads Around the World.”

EV production continues to grow, but China’s real estate market tells a different story. Home prices have declined in 40 of the past 43 months. That long-running weakness weighs heavily on consumer sentiment, which remains subdued.

A sluggish property market and a wary consumer are hardly signs of robust copper demand.

Conclusion: Dr. Copper Still Has a Say

So, does copper still hold predictive power? Yes, but with caveats.

There’s plenty of noise in the current price signal, particularly from U.S. trade policy and speculative flows. However, when considered alongside other macro indicators, I still believe the probability of a near-term U.S. recession remains relatively low.

And let’s not forget: a mild economic dip might not hurt Trump’s election strategy either. If the economy stumbles, it becomes politically convenient to blame Biden.