Old vs. New – The recent rally in perspective

Many asset classes benefit from potential Fed rate cuts, soft landing expectations, and a lower USD. But a bigger, more profound rebalancing is happening.

The past few weeks in the financial markets have been nothing short of spectacular. Few investment categories aren't on the rise, with occasional new 'all-time highs' being achieved. It also means every investor gets the opportunity to put his/her narrative on market developments, even when they are usually wrong. Here's my 'multi-asset investor 'perspective.

Lower and Faster

Except for oil and emerging markets, the primary catalyst for the exuberant market sentiment revolves around Federal Reserve rate cut expectations. Fed Chairman Powell took over a year to convince markets that the US central bank would continue raising rates. Still, just a few months later, investors have overwhelmingly abandoned the 'higher for longer' story.

And not without reason. First, artificial tightening occurs if the Federal Reserve keeps interest rates at 5.50% for an extended period. This is because inflation and inflation expectations are steadily decreasing (even though some of the underlying data suggests stickiness.) In other words, real interest rates rise without taking action, and higher real rates generally imply lower economic growth. As a result, markets are pricing in more than five 0.25 percentage points rate cuts between now and January 2025.

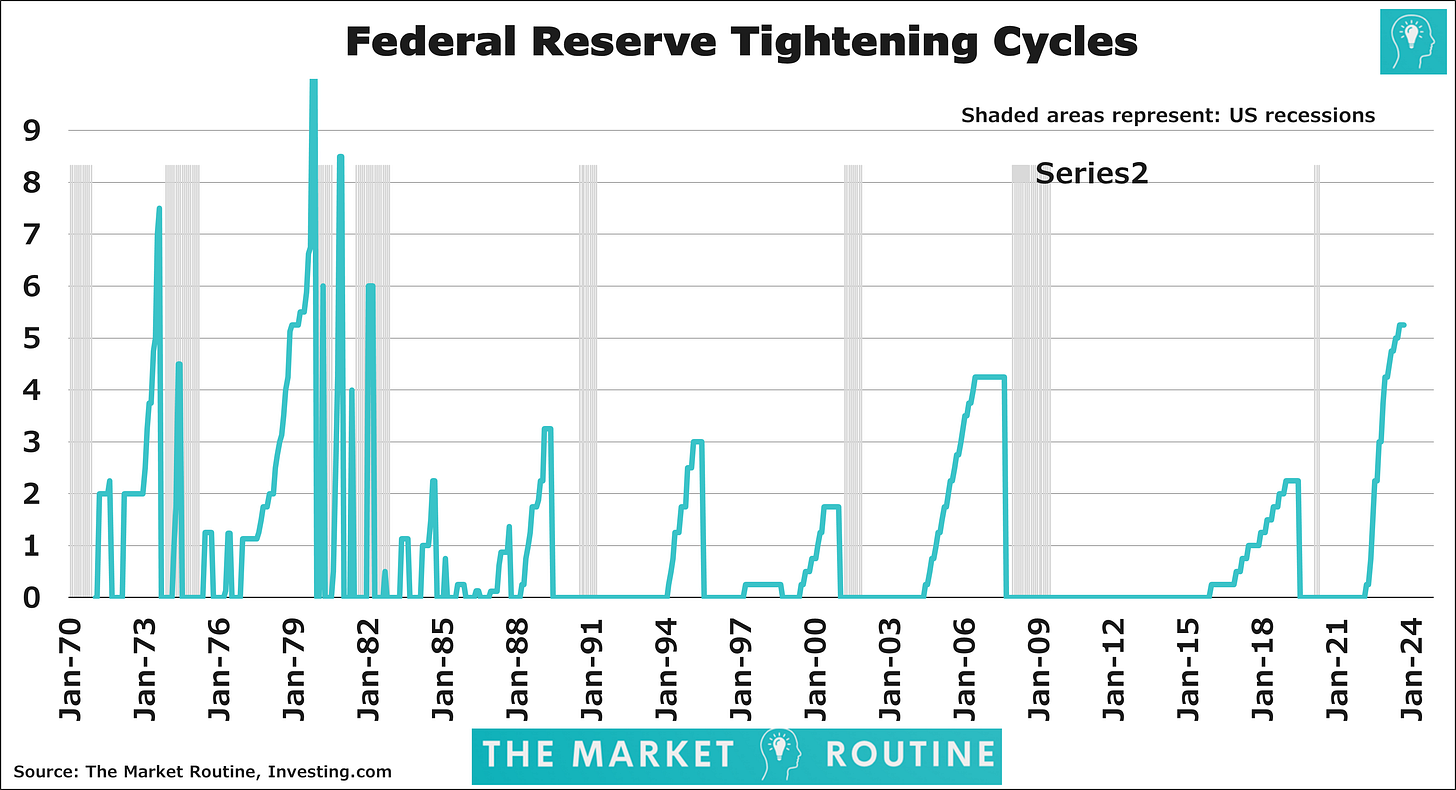

Investors are combining these rate expectations with a unanimous belief that the US economy is heading for a soft landing. However, here's where a problem occurs. In the past, almost all – with one clear exception in the 1990s – major tightening cycles by the Federal Reserve eventually led to a recession. And while most of my recession indicators provide a mixed picture, that's still significantly different from not pricing in a recession at all, as the markets are doing.

The Dollar

Due to lower Fed rates, the US dollar has significantly depreciated. The US Dollar Index (DXY), which reflects the USD's value against other major currencies, has declined by about 3% since early October. A weaker dollar typically means asset classes priced in dollars, such as gold, rise. Moreover, a significant portion of international trade and a substantial amount of debt in emerging countries are denominated in dollars. Therefore, a weaker dollar often coincides with an improvement in the market segment.

Here's another 'but.' If the Fed needs to cut rates, other central banks likely have to follow suit. Take the ECB, for example. Rates are also relatively high here, with the significant difference from the US being that the economy is barely growing. And I expect the next few quarters won't be much better. It may very well be that the ECB has to lower rates before the Federal Reserve does. The story of a weakening US dollar probably ends there. The same applies to the Bank of England, as the English economy hasn't grown since March of this year.

Nobody owns gold

Is there more to the story? Absolutely. Despite the declining dollar, the price of oil continues to drop. OPEC, led by Saudi Arabia, insists that this is primarily due to supply, which is why they've announced additional production cuts, albeit half-heartedly. Fewer OPEC companies are ready to give up market share to non-OPEC countries ramping up production.

As for Bitcoin and Gold, we have entered a phase in which these alternative investments are increasingly viewed and accepted as meaningful additions to a diversified multi-asset portfolio.

Yet, the allocation to gold – the asset class with by far the longest track record – is still remarkably low. A recent survey by Bank of America indicates that 71% of American investment advisors recommend a gold allocation between 0 and 1%. That's almost nothing.

Bitcoin – a supply and demand story

In the case of Bitcoin, investors are eagerly anticipating the next 'halving,' where Bitcoin miners' rewards are halved again. My recent study on previous Bitcoin halvings suggests that economic and market conditions in April 2024, when the next halving is expected, could be fairly comparable to those around previous halvings.

Decreasing supply is an important factor likely to influence Bitcoin's price development during the halving cycle. The Glassnode chart below shows that the share of Bitcoins held for over a year has risen to 70%. And although rising prices will convince more investors to sell, the 30% share of short-term supply is exceptionally low. Add to that the high likelihood of receiving SEC approval for US spot Bitcoin ETFs early next year, and it's far from unthinkable that (a lack of) supply will be the catalyst for this halving.

Conclusion

To conclude, I believe that markets are focusing a bit too much on upcoming rate cuts and not enough on the historical context of those cuts. Periods of significant rate hikes have typically had a delayed but negative economic impact. Additionally, the process of a large-scale rebalancing of multi-asset portfolios seems to have accelerated. I believe that a future-proof portfolio should have a better balance between traditional and alternative (especially scarce) asset classes. This offers new opportunities in terms of returns.

Jeroen