The World Gold Council recently reported that central banks collectively purchased a net total of 60 tons of gold in October—the largest monthly purchase of 2024. This trend shows no signs of slowing, driven in part by the fact that many of these buyers are not particularly fond of the U.S. dollar.

Emerging Economies Lead the Charge

In October, the usual suspects topped the list of largest gold buyers: India, Turkey, and Poland. The chart below shows a clear pattern: emerging economies dominate gold purchases.

This is no accident. Many of these countries, such as Turkey and Russia, are actively diversifying away from the dollar. Meanwhile, other large emerging economies hold relatively low amounts of gold in their reserves:

China: Less than 5% of reserves in gold.

India: Around 8%, even after recent acquisitions.

South Korea: Just 4%.

Too Little Gold

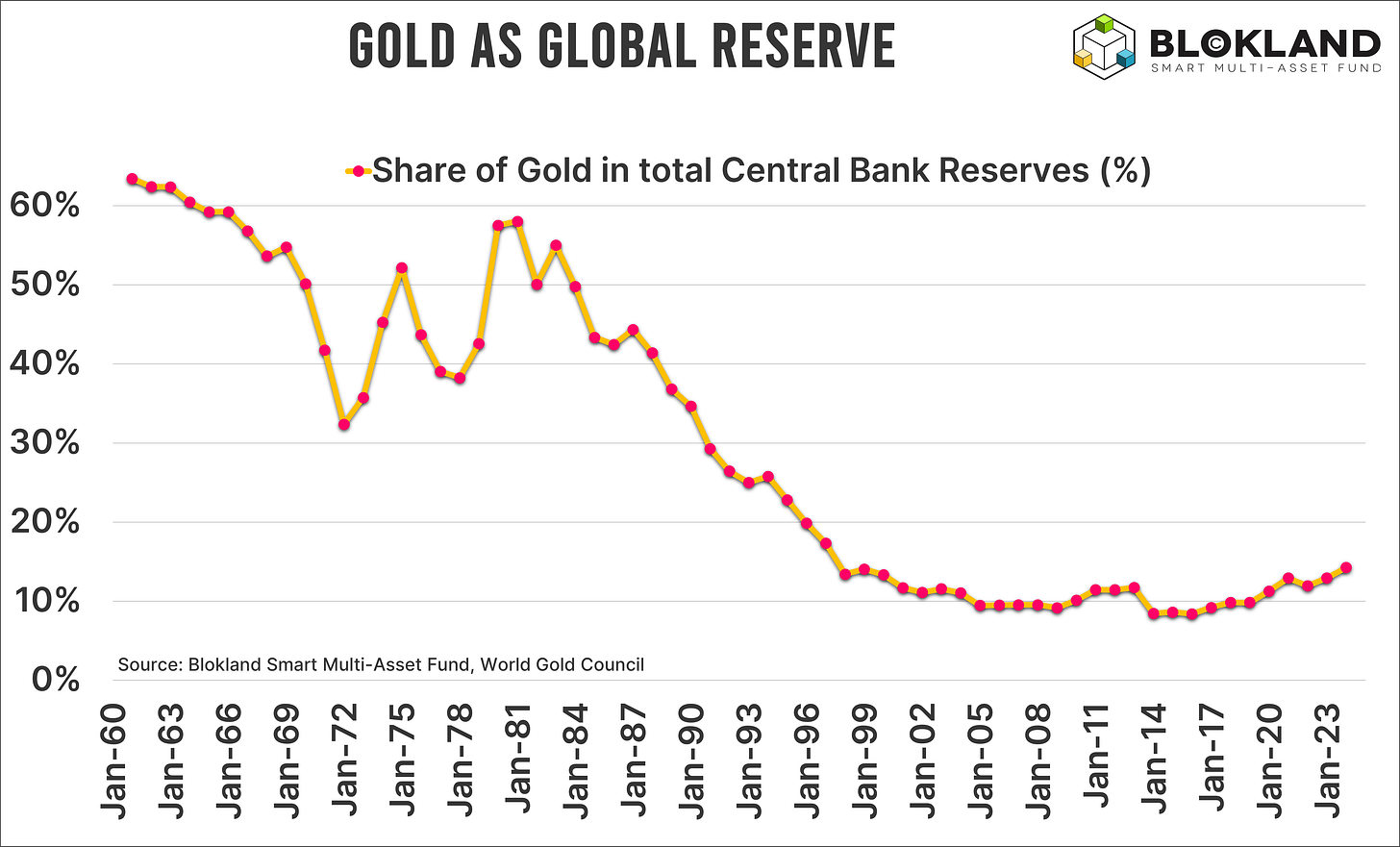

These figures are low not just in absolute terms, but also relative to the global average. The chart below highlights that, at the end of 2023, gold comprised only about 14% of global reserves. Countries like China, India, South Korea, and Japan fall significantly below this level.

But there’s more to the story. Historically, gold made up a much larger share of reserves. In the mid-1980s, the average was between 50-60%. This means today’s 14% allocation is a fraction of what it used to be.

If you believe, as I do, that increasing the share of gold in reserves is essential to stabilize the debt-driven financial system, then gold holdings must rise significantly.

The Case for Buying More Gold

Emerging economies with low gold reserves are also increasingly dissatisfied with the dollar's dominance. This dissatisfaction makes the future path clear: they will continue buying gold.

In fact, when surveyed about the future share of gold in global reserves over the next five years, an overwhelming majority of central banks anticipated it would be “higher.” The chart below, based on a mid-year survey, shows that 44 of 57 respondents were from emerging economies.

Conclusion: What These Numbers Tell Us

Central Banks Will Continue Buying Gold:

Many central banks still need to increase their gold reserves to align with the global average. If the global average itself rises, even more gold purchases will be necessary.Price Agnostic:

Central banks aren’t concerned with short-term gold price fluctuations. Their priority is strengthening their monetary systems and reducing dependence on the U.S. dollar. Unlike typical gold investors, central banks are focused on long-term stability, not market timing.

Now that is purchasing power.