The Average Return Doesn’t Exist!

Predicting Long-Term Average Returns is both A Lame and Flawed Forecasting Strategy

Every year, I watch with a mix of amazement and skepticism as major financial institutions release their annual forecasts, particularly their predictions for ‘next year’s return.’ More often than not, these forecasts are conveniently close to the long-term average. And every year, I know one thing with certainty: they will be wrong.

A Flimsy Strategy

Basing stock market forecasts on long-term average returns is a profoundly weak and uninspired strategy. Because the average return rarely materializes. You’d be better off adopting a stance of relentless optimism. Even perpetual pessimism garners more credibility than playing it safe with bland, middle-of-the-road predictions. Let me show you why.

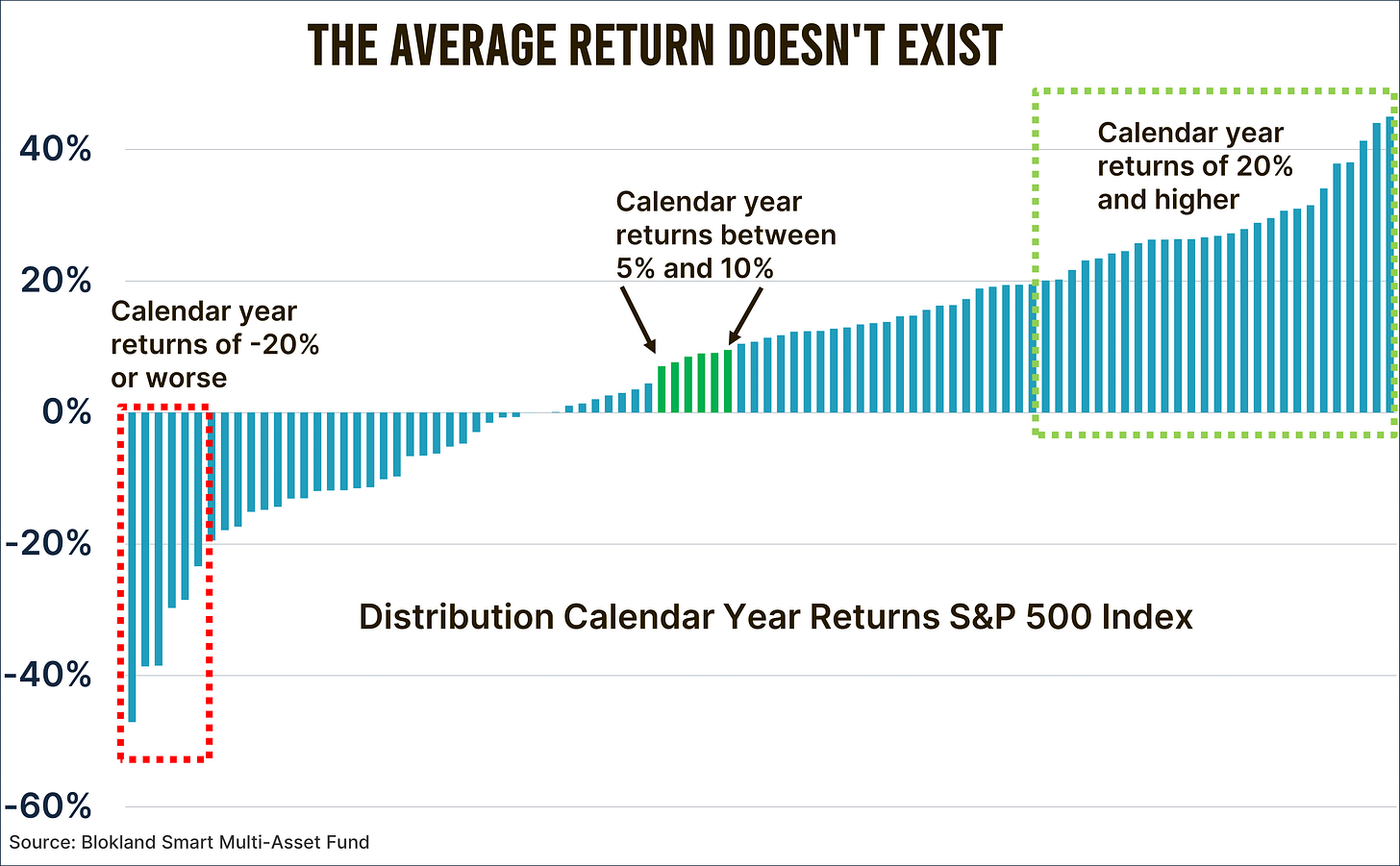

Since 1927, the (back-calculated) average annual return of the S&P 500 Index has been 7.9%. On the surface, predicting a range of 5% to 10% might seem reasonable. But the underlying data tells a different story.

Out of the 96 calendar years since 1927 (2024 is not over yet), the S&P 500 has posted returns within that 5%-10% range a mere six times. That’s a success rate of only 6% for these so-called “reasonable” predictions. And with the S&P 500 already up more than 25% this year, the chances of hitting that target in 2025 are slim to none. As a “market guru” making this kind of lazy forecast, you’d have been correct just 6% of the time—a dismal track record.

Go Bold or Go Home

A much better and bold strategy would have been to predict that stocks would rise by 20% or more each year. Historically, this would have been the case in 28 out of 96 years, giving you a 29% success rate. In other words, you’d have been correct nearly one out of three times—five times as often as those timid 5%-10% forecasters.

Even taking the path of a perennial pessimist wouldn’t have been worse than hugging the average. Since 1927, the Dow Jones has declined by 20% or more in six years. While predicting such a steep drop takes considerably more courage (and risks damaging one’s career), it earns more respect than the bland and uninspired middle-ground approach.

A Lack of Historical Awareness (Again)

And here we are, yet again. At the time of writing, the average return prediction for the S&P 500 from 24 major investment banks for 2025 is, unsurprisingly, 8.2%—very close to the long-term average. Of these 24 forecasts, 11 predict returns between 5% and 10%—nearly half of all participants. Yet history shows there’s a 94% chance they’ll be wrong.

Even more disappointing is that not a single one of these so-called experts dared to predict a return greater than 20%. Statistically, there’s a 29% chance of a return exceeding that threshold. You’d think at least one of these institutions would incorporate the historical distribution of returns into their forecast. Apparently not.

That said, there is one outlier this year: BCA Research predicts that the S&P 500 will decline by 25% in 2025. Naturally, their bold stance makes them stand out, and they earn a mention here, while the bland, gray masses fade into obscurity.

Respect for Bold Predictions

I think the odds of another year with 20%+ gains are higher than those of a steep decline. But I respect BCA Research for taking a clear and bold position. Despite overwhelming historical evidence, the fact that none of the major banks predicts a 20%-plus return is downright alarming.

Not only should we take these forecasts with a grain of salt, but we should also question the credibility of the institutions behind them. Being timid in the face of data is not just uninspired—it’s negligent.

The average return might be a nice benchmark, but it’s not a reality. As history repeatedly shows, the average return doesn’t exist.

I wish you a very happy, inspiring, and rewarding 2025!