The ECB really believes it can sell you everything!

This was perhaps the most conflicting statement in ECB history

The ECB is divided. And to appease everyone, they crafted a statement attaching the latest rate hike that's shaky from all angles. Unworthy, really, of a central bank.

Sheer BS

Forget for a moment whether this was indeed a 'dovish hike' – I'll get to that shortly – what the ECB has managed to put in its official statement is unprecedented and shows a lack of self-awareness.

The line in question is:

'Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.'

This leaves little room for interpretation. The ECB believes that by keeping the interest rates high for a prolonged period, it can manage a prompt return of inflation toward target.

Seriously, what does the ECB mean by timely? According to the Merriam-Webster dictionary, timely is described as: 'coming early or at the right time.'

Since August 2021, the Eurozone headline inflation has come in above the 3% threshold – which I'm using here as the definition of 'deviation from target.' That's two years of the ECB not meeting its inflation goal.

And it doesn't stop there. The ECB raised its inflation forecast for 2023 and 2024, predicting 3.2% inflation for next year. It's not even close to target.

How can you claim in one sentence that you need to keep interest rates high for long enough, even after by far the biggest tightening cycle in ECB history, to ensure a timely return – which for the ECB covers three years(!) – of inflation towards the target? This is utter nonsense and, in my view, does not contribute to restoring creditworthiness.

Dovish hike

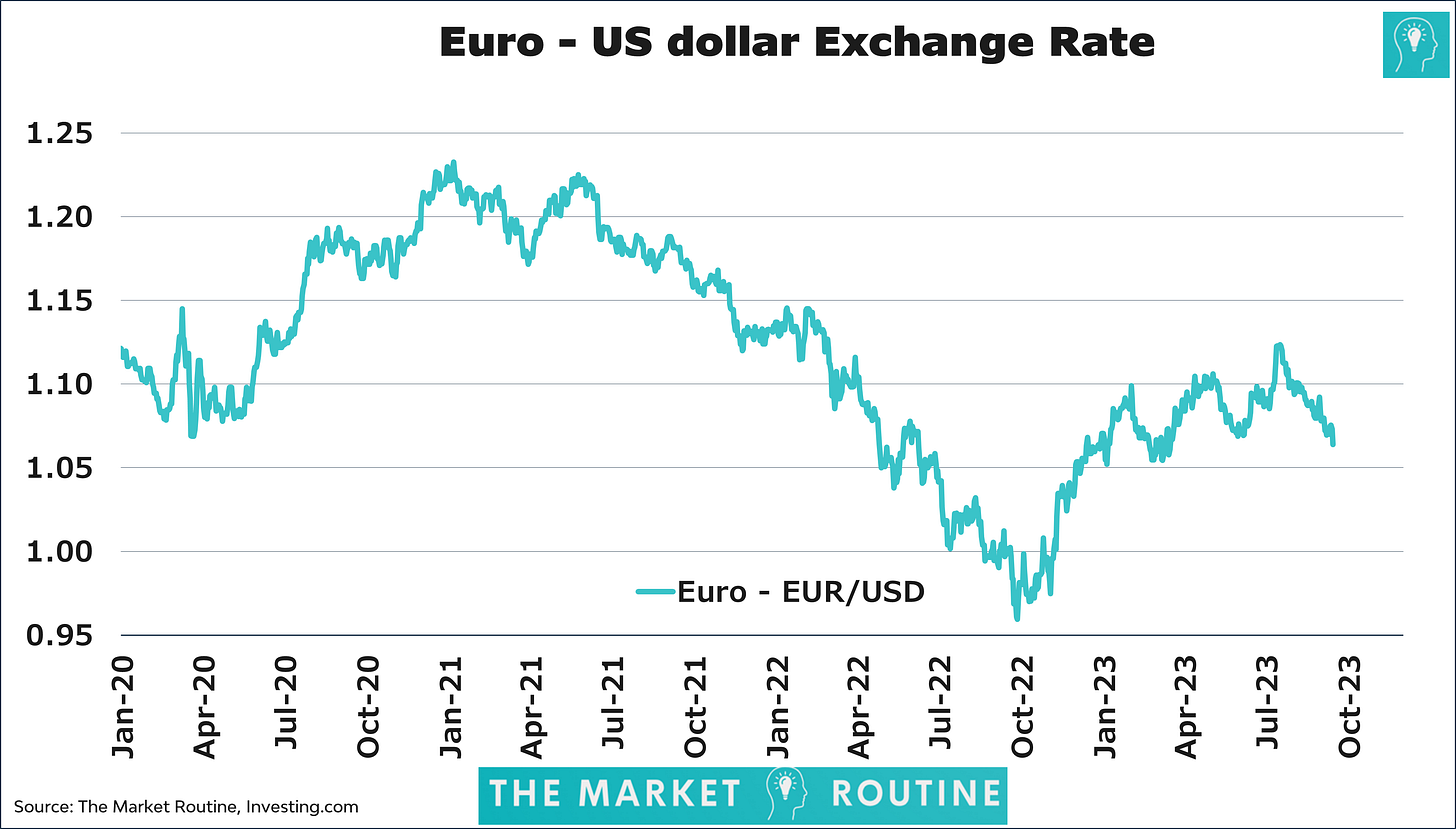

The question remains whether this can be seen as a dovish hike. On paper, yes. Lagarde mentioned that some Governing Council members would have preferred a pause, and the bizarre contradiction in the ECB statement suggests this has been a compromise: a rate hike with the mention that it will keep rates there (for an extended period. In other words, this likely is the end of the series of rate hikes. The key reason why the euro is collapsing.

Hard landing

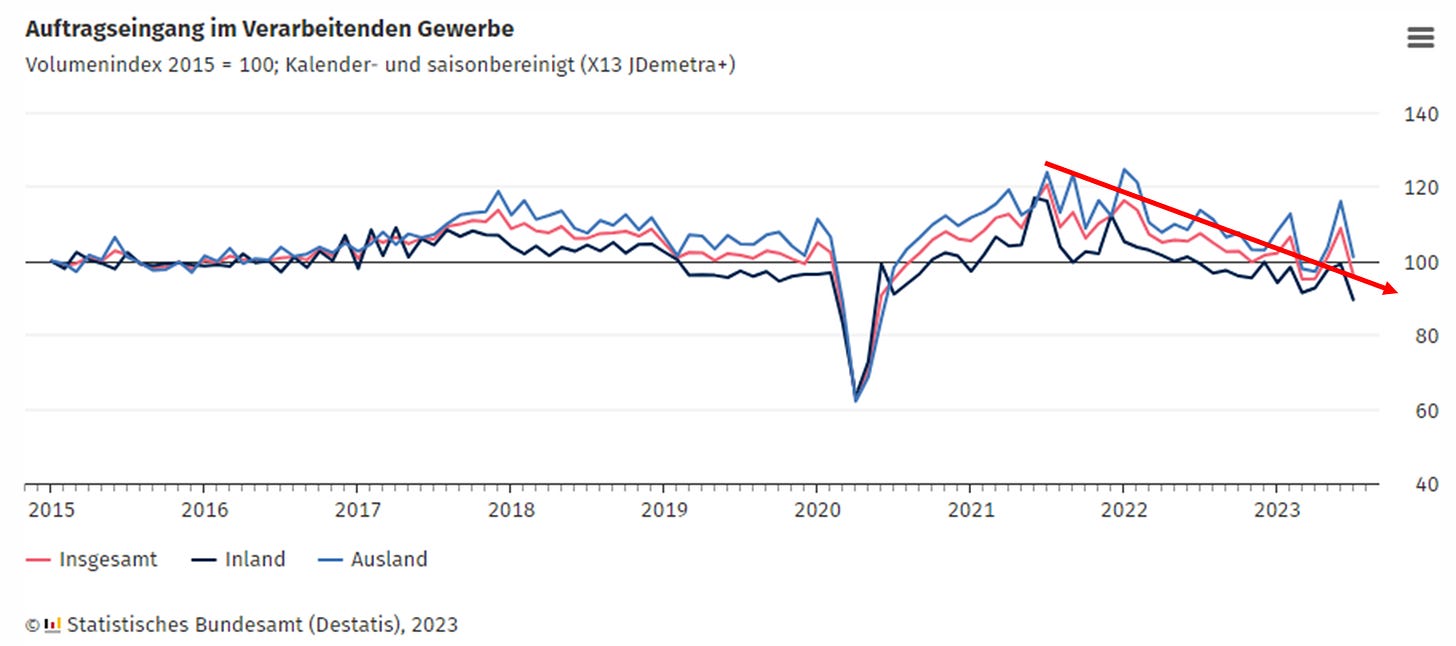

And while European equity markets are celebrating the ECB's decision, the chances that we will later label this last increase as a policy mistake are considerable. Unlike the US, both the Manufacturing and Services PMI are negative in the Eurozone. The narrative of a resilient service sector doesn't hold. The recovery of consumer confidence is stalling, leaving it at a meager level. And German macro figures are downright poor, with the ongoing decline in factory orders being a prime example.

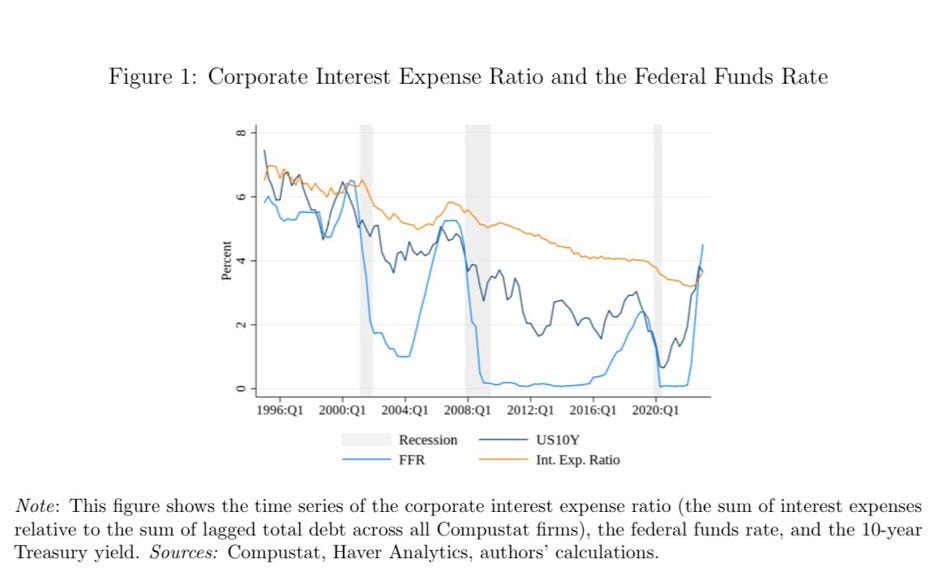

In addition, I don't quite buy the story that exploding interest rates have no impact on expenditures and profits. A recent paper shows that, for instance, the interest expense ratio of, in this case, American companies is indeed on the rise. With interest rates rising across the curve, any refinancing will impact earnings, no matter how small.

But that's a topic for another time. The conclusion here is that the ECB is deeply divided and probably has no idea if its current policy is inherently sufficient to bring down inflation. But instead of admitting that, we are slapped with a bizarre statement intended to prove the bank's correctness. Well done, Lagarde!