Scarce assets like gold and Bitcoin were the top-performing asset classes of the past year. Yet, they received little to no attention in the endless (and often dull) outlooks from major investment banks and asset managers. Thankfully, there are always exceptions to the rule.

Riding the Debasement Trade

At the start of this year, JP Morgan analysts led by Nikolaos Panigirtzoglou published a report predicting that the "debasement trade" still has a long way to go.

The debasement trade refers to investments in (scarce) assets that provide protection against the ongoing devaluation of fiat currencies due to inflation, rising debt levels, and geopolitical tensions.

It doesn’t take much digging to see that none of these factors are in short supply. Inflation in the Netherlands has surged beyond 4%, and globally, currency debasement remains a persistent issue. Meanwhile, budget deficits of 5% to 6% have become the norm—ironically, with exceptions being countries that could afford to spend more, such as the Netherlands.

Political turbulence is equally abundant, with increasing polarization becoming ever more apparent. And the Trump factor will not calm these waters.

When combined with the fact that most investors hold very few scarce assets in their portfolios—the traditional investment industry stubbornly clings to systems focused solely on equities and bonds—JP Morgan suggests that the rally in scarce assets is far from over.

Hard Data

The arguments from Panigirtzoglou and his team are compelling, without question. In fact, I would take it a step further. The need to strategically adjust (multi-asset) portfolios is driven not only by rising risks related to prices, debt, and politics but also by more traditional considerations.

From a conventional perspective, the case for increasing allocations to scarce assets at the expense of bonds is becoming increasingly robust.

Using historical data only —a standard but rather uninspired approach to constructing strategic portfolios—the results for portfolios composed solely of stocks and bonds are less than impressive.

For instance:

A 60-40 portfolio with 40% gold instead of 40% bonds has achieved a comparable Sharpe ratio over the past 50 years. Over shorter periods, the alternative portfolio with gold often outperforms.

Bond volatility relative to equities has risen to its highest point in over 20 years.

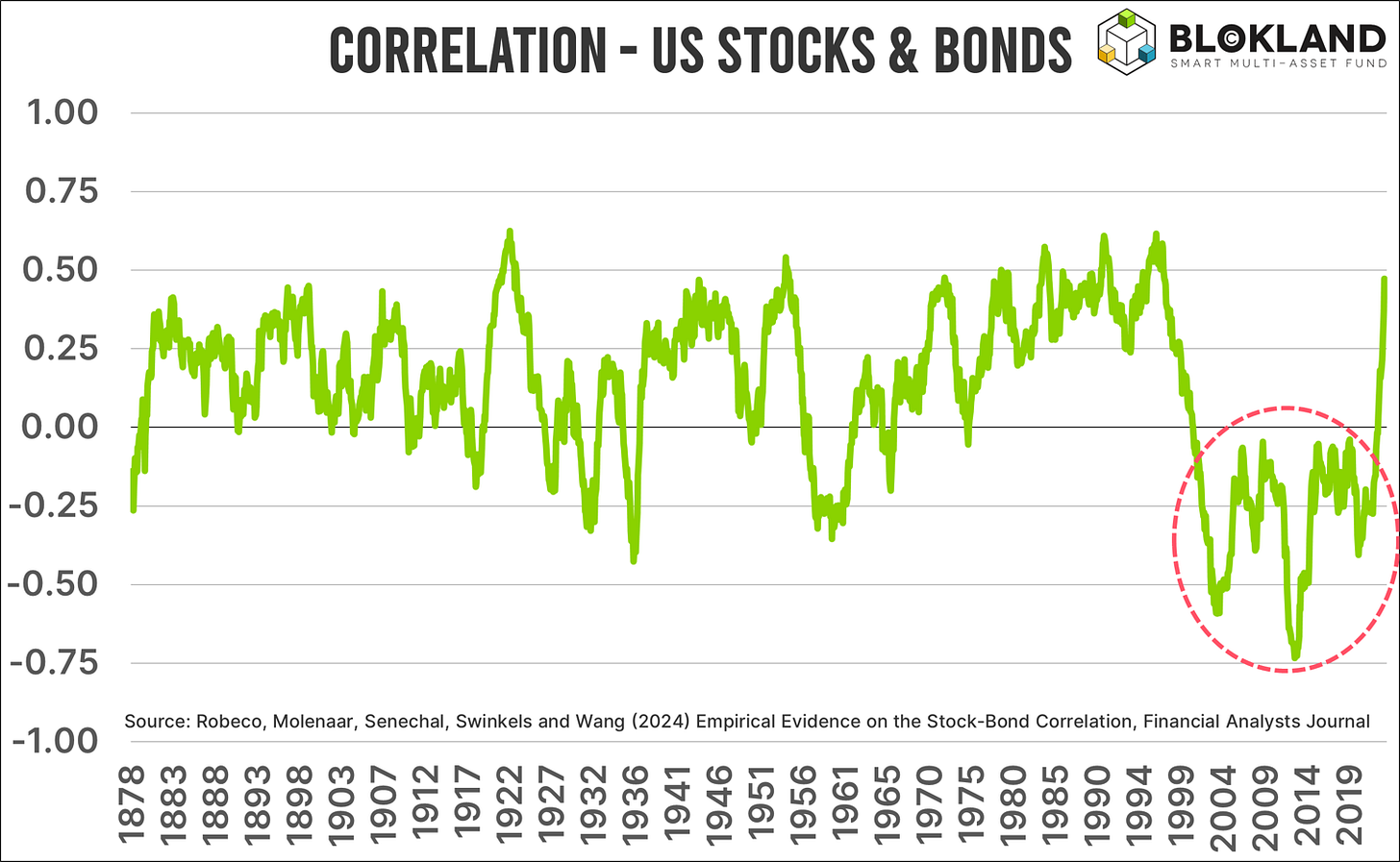

Historically, the correlation between stock and bond returns has averaged positive rather than negative.

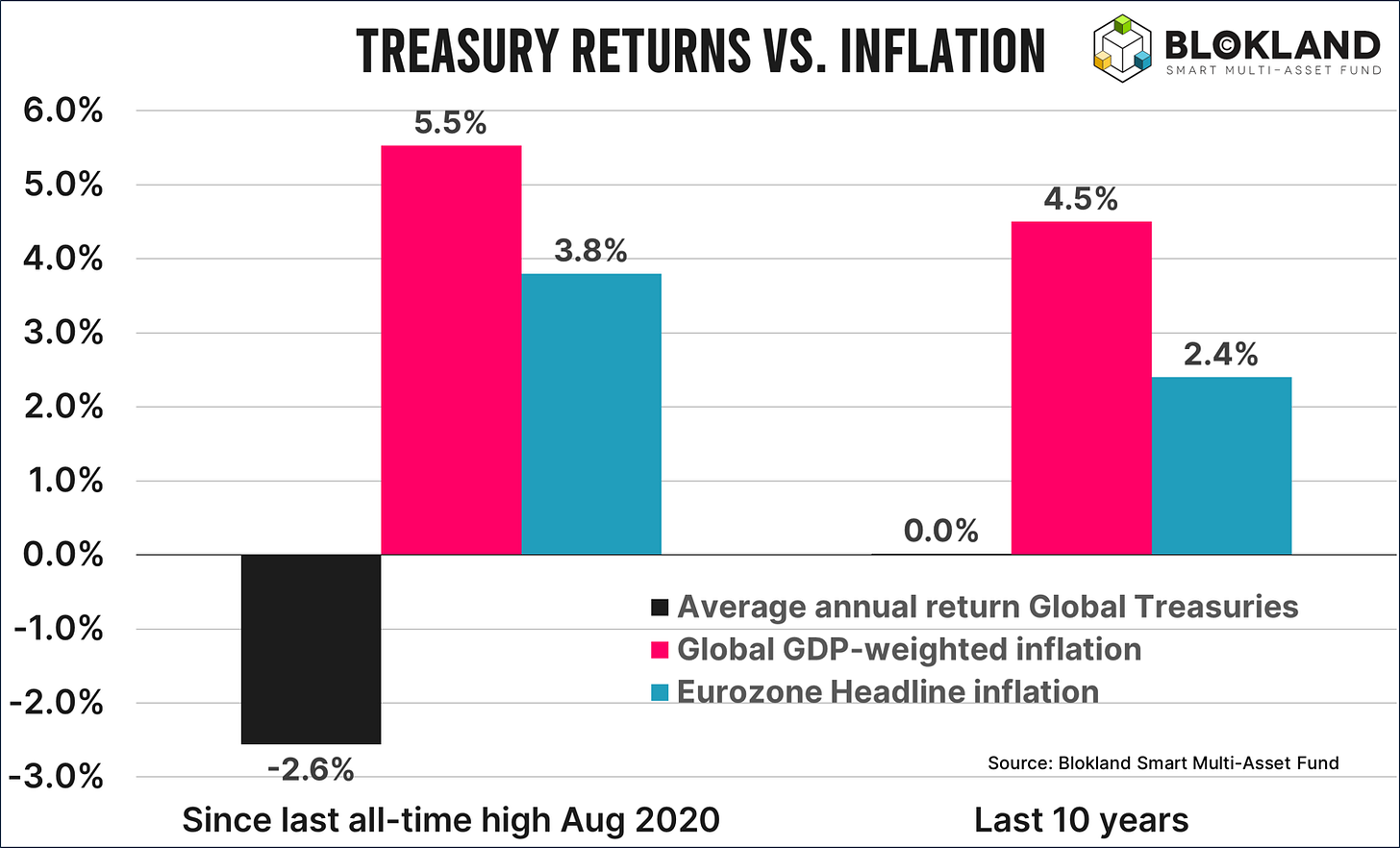

When inflation is factored into portfolio construction, you must go back more than 20 years to find reasonable returns for bonds in the traditional mix. Feeding this data into a "neutral" optimization model often results in bonds being allocated far less than 40%.

The Great Rebalancing

The combination of global (financial) developments and hard data has led me to frame this structural shift in investment portfolios as The Great Rebalancing. While the ongoing debasement of fiat currencies is a key component, this term more accurately captures the broader trend. It represents a strategic realignment of asset allocations, driven by both industry dynamics and external factors.

The conclusion is clear: ensure, for your clients' sake, that you aren’t the last to adapt.