The Myth of 60-40: Time to Wake Up!

Over the past five years, a portfolio that invests in gold instead of bonds has outperformed on nearly all occasions.

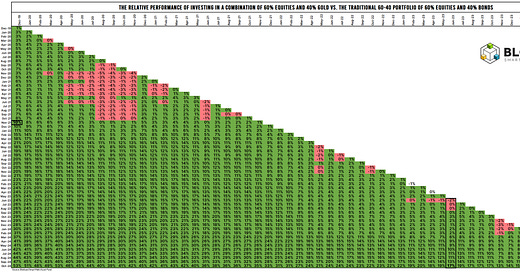

As you know, I love a good chart—especially one that delivers a powerful message. My latest chart might just be the wake-up call many investors need. While traditional portfolios suffer from the drag of bonds, those focused on scarce assets, like gold, are achieving exceptional results.

Gold, not Bonds

Let me introduce my latest charting ‘piece of art’ below. It’s all about returns—or, more specifically, the difference in returns.

Each cell in the chart shows the return differential between a portfolio allocated 60% to global equities and 40% to gold versus the traditional 60-40 portfolio (60% global equities, 40% global bonds).

The calculations cover every month from December 2019 through October 2024. The return differentials are cumulative. To give you an example: If you invested in a 60% equity and 40% gold portfolio in January 2020 and exited at the end of December 2021, you would have outperformed the traditional 60-40 portfolio by 10% (as shown in the first column next to “Dec-21,”).

Similarly, if you switched to the gold-based 60-40 portfolio on June 1, 2023, you would have experienced slightly lower returns in the first three months (red cells). However, by October 2024, you would have outperformed the traditional 60-40 portfolio by a whopping 17%.

A Sea of Green

Using this method, I calculated nearly 1,800 combinations of starting months and investment periods. The results are overwhelmingly clear: the chart is predominantly ‘green.’ A portfolio with gold has nearly consistently outperformed one with bonds.

Here are the key conclusions:

100% Outperformance:

By the end of October 2024, if you had invested in the gold-based 60-40 portfolio, you would have outperformed the traditional portfolio in every case since January 2020 (all green cells in the last row).

Massive Performance Gaps:

Since January 2020, you would have outperformed the traditional portfolio by 58%. Even if you only switched to the gold portfolio at the start of 2024, your returns would still be 15% higher than having invested in the traditional 60-40 portfolio.

Bonds Rarely Win:

Fewer than 7% of all starting month and investment period combinations resulted in the equity-bond portfolio outperforming the equity-gold portfolio.

Isolated Underperformance:

The few periods when the gold portfolio underperformed were mainly concentrated immediately after the COVID outbreak. During that time, central banks slashed rates aggressively—sometimes below zero—and liquidity dried up. The maximum underperformance was just 5% (starting in August 2020 and exiting in November).

As mentioned above, the maximum outperformance of the gold portfolio over the bond portfolio was a staggering 53%.

This analysis spans nearly five years, a significant timeframe in investing. But to find a period where the traditional bond-based 60-40 portfolio outperformed, you’d have to go back much further in history.

Critical Questions for Asset Managers

These results pose serious questions for professionals managing long-term (strategic) or short-term (tactical) asset allocations, if they’re not already asking these questions themselves.

Contrary to what you might expect, the strategic allocation of many portfolios is primarily determined using historical data. Between the late ’80s and the Great Financial Crisis, such data supported the 60-40 portfolio as a solid foundation for diversification.

But that assumption no longer holds. In addition to rising debt, central bank policies, and inflation risks—which I discuss regularly—the historical evidence also supports adding gold to any diversified portfolio. And yet, this idea remains largely ‘overlooked.’ It’s my mission to change that—with a chart that speaks louder than words.

Wake Up, People!

The era of relying on bonds to balance equity risk likely was the outlier. The data is clear: portfolios incorporating gold instead of bonds have delivered superior returns for years. It’s time to rethink outdated strategies and embrace a more rewarding approach to diversification.

Are you ready to wake up?