The real shift towards scarce investments is yet to come!

Family offices and other professional investors are currently doing very little with gold and Bitcoin.

From the Blokland Smart Multi-Asset Fund newsletter:

I will focus on a straightforward question: What does the asset mix of family offices look like today? Family offices handle wealth management and other financial services for families and family-owned businesses. I track them because they tend to be more progressive than old-fashioned, traditional wealth managers, which offer nothing beyond a mix of plain-vanilla stocks and bonds.

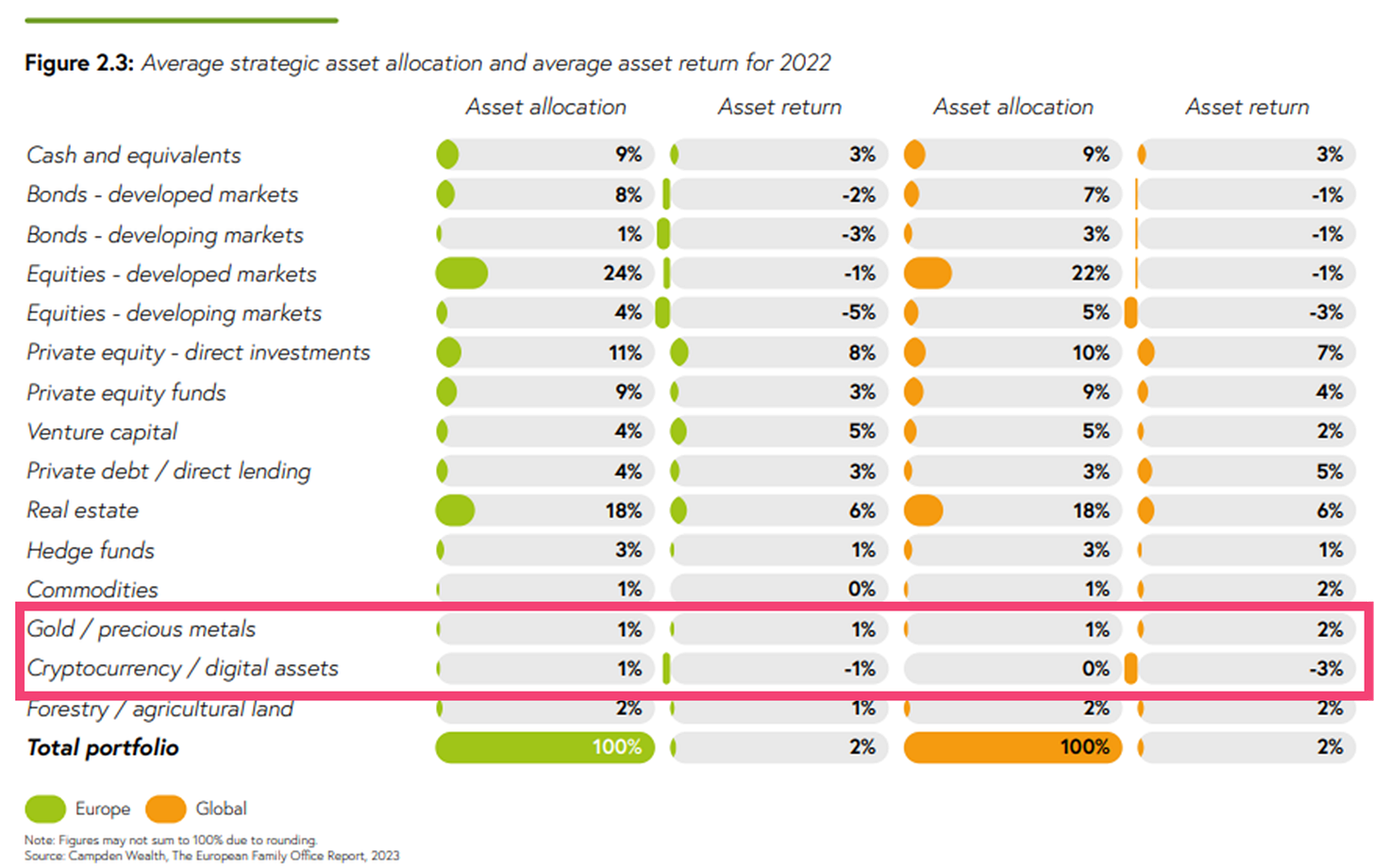

The chart below shows the average investment mix of family offices tracked by Campden Wealth. Each year, they publish 'The European Family Office Report,' highlighting key developments and trends. The data presented here is from the 2023 publication; this year's report has yet to be released.

Better Diversification

The graph shows that family offices are much more diversified than the average wealth manager or private bank. While they still significantly invest in bonds—a trend I expect to diminish in the future—the weight of bonds in their mix is significantly lower than that of the aforementioned wealth managers and private banks.

Gold and Bitcoin Virtually Absent

However, the allocation towards scarce investments like gold/precious metals and Bitcoin (grouped here as cryptocurrency) is also striking, as it is extremely small. The exception is real estate, which, especially concerning residential properties, also exhibits scarcity. Despite their promising outlook as a hedge against the ever-mounting debt burden and the flood of money printed by central banks, family offices have yet to embrace Bitcoin and gold. They allocate a mere 2% to these categories in total.

This, however, is good news. I'm convinced that family offices and other institutional investors will expand their positions in gold and Bitcoin. Since the launch of the Blokland Smart Multi-Asset Fund, I've had numerous discussions with professional investors, and there's a significant increase in demand from their end clients. We're still in the early stages of investor adoption.

Private Markets – A Good Idea?

I'd like to address one other aspect of the family office asset mix that also points towards a shift towards scarce assets: private markets. In recent years, there's been significant hype about more (professional) investors turning to private markets such as private equity and private debt.

However, investors need to consider two factors. First, while private markets can indeed deliver solid returns, it's crucial to select the right projects and companies. This task becomes exceedingly challenging, with so many companies raising funds to invest in the 'best' opportunities. Unfortunately, investors often realize this too late, as valuations are performed sporadic at best. Research indicates that different parties can value the same investment very differently, often diverging several percentage points.

Private Markets – High Risk

This brings me to my second and most significant caveat of private markets: volatility. Due to the infrequent (re)valuations of private investments and the subjective and slow release of new information, volatility is artificially suppressed. And understating volatility has a very substantial impact. Below is a graph from Pitchbook, an investment data provider, illustrating the influence on reported volatility.

Don't focus too much on the quantity of data or the lengthy title in the graph; instead, pay attention to the two private market investments outlined with a pink rectangle. These are Private Equity (PE) and Private Debt. When you adjust for the slow and subjective valuation adjustments, the 'true' volatility doubles(!). For Private Equity, volatility increases from 10.7% to 20.5%, and for Private Debt, it goes from 4.9% to 8.2%. Volatility understating happens all the time, and it has an official name – 'volatility laundering.' Similar to the concept of 'green-washing' in ESG investments, where investments may not be as 'green' as promised, volatility laundering means taking on much more risk in your portfolio than advertised.

A Shift towards Genuine Diversification

Why do I delve into private markets extensively? Simply because I anticipate that family offices and other institutional investors will eventually partially divest from private markets. Private Equity and Debt are ultimately equities and bonds. The high actual volatility implies that the risk-return profile and diversification benefits of these markets are much less favorable than perceived. Therefore, they'll have to seek alternatives. Gold and Bitcoin will certainly be included, precisely because of the genuine diversification power these investments offer.

Finally, I expect old-school, traditional investors to ultimately seek alignment with more progressive family offices. This means we're only at the beginning of the shift towards scarce investments. In this regard, you can't be early enough.