This Is Not the End of the Carry Trade!

Extreme monetary policy to artificially keep rates down will fuel the Yen Carry Trade for years to come.

The Bank of Japan unexpectedly raised interest rates, and for those who did anticipate it, the hike was larger than expected, causing an 'all hell to break loose' atmosphere in markets. Yet while stock market perma bears emerged from their hideouts to proclaim the end of the Yen carry trade and, thus, the world, it is unlikely that they will have it right this time. However, investors would do well to remember August 5, 2024; the likelihood of this scenario repeating should not be underestimated.

A Heavy Burden

The Yen carry trade is a tried-and-true recipe, especially for yield-hungry fixed-income investors. Borrowing money in Japan costs almost nothing, allowing investors to deploy that borrowed capital into higher-yielding investments elsewhere. As long as yield differentials remain substantial and volatility is kept in check, including the currencies involved, it's a 'great' strategy on paper.

However, chaos ensues if the Bank of Japan breaks the 'agreement' with investors and raises rates, particularly in larger steps than before, while the rest of the world quickly heads towards rate cuts. Apart from the narrowing interest rate differential, such as between Japan and the United States, the central bank-induced uncertainty leads many investors to think: 'Let's hold off on that carry trade for now.'

The End?

What amuses me are the headline hunters who almost immediately proclaim the end of the carry trade and predict significantly lower markets. While I do not dismiss the latter, especially with rising tensions in the Middle East and the Federal Reserve's missed opportunity to cut rates to avoid being cornered by the market, the odds they are wrong are high. By the way, I'd like to ask all the gurus and experts who stubbornly insisted until about two weeks ago that the Fed wouldn't cut rates and ridiculed my expectation of three cuts, how they feel now.

Regardless, while prices can fall, claiming that the carry trade is over is a wild assumption often lacking substantiation. First, the Bank of Japan has failed to get inflation anywhere near 2% over the past decades. Oddly enough, the Bank of Japan unrealistically sticks to the same definition of price stability as the Federal Reserve.

Limited Potential

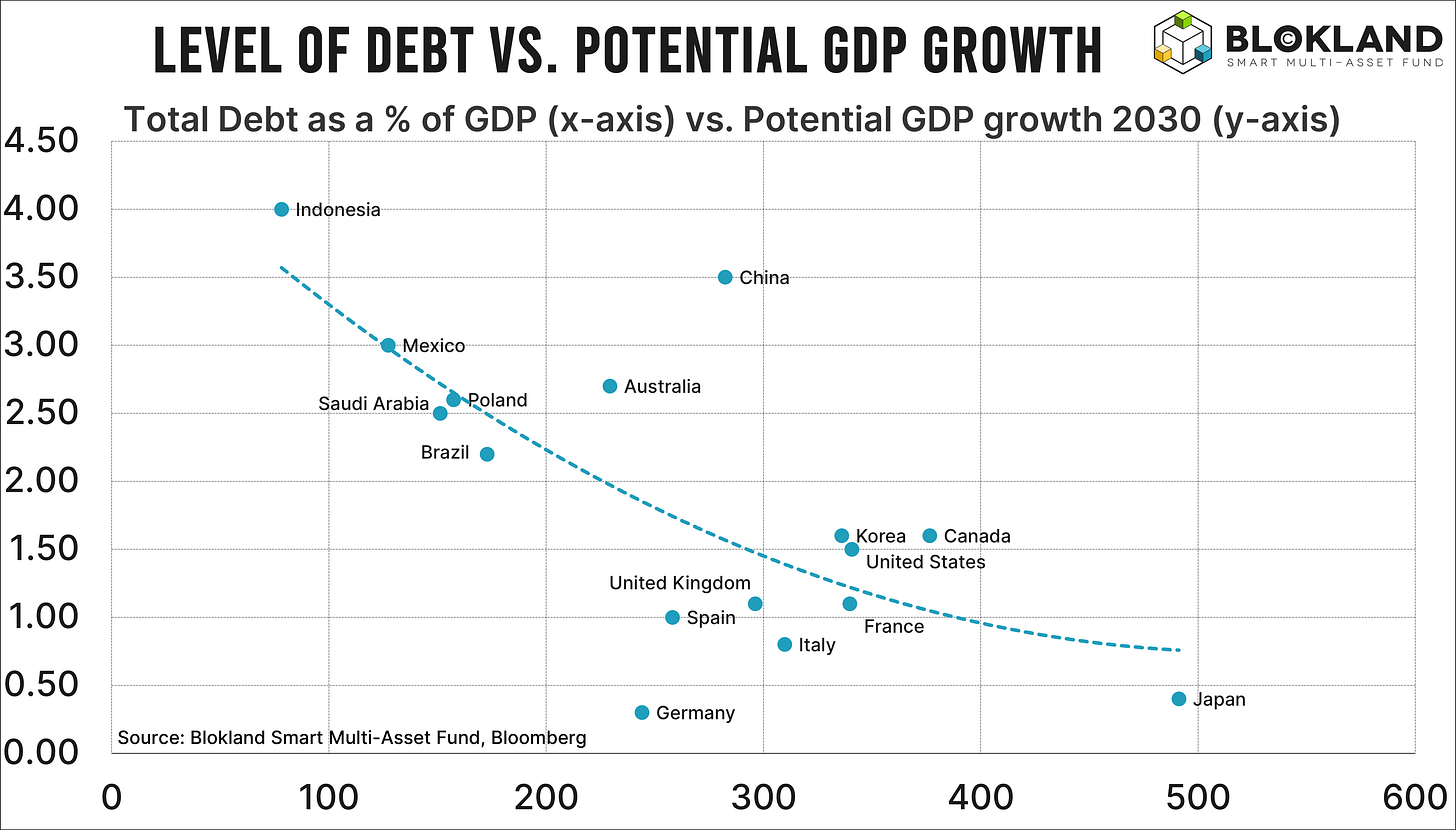

The reason the Bank of Japan has almost never achieved 2% inflation and is unlikely to do so going forward is because Japan barely grows. In fact, based on recent estimates, Japan's potential GDP growth will turn negative within ten years. The Japanese will start to structurally shrink a couple of years from now. A declining economy and 2% inflation? Good luck with that. This sheer lack of growth potential and the Bank of Japan's extraordinary policies – it's no coincidence that the Bank of Japan reinvented yield curve control – are the basis of the continued existence of the carry trade.

Below is a chart showing the relationship between potential GDP growth and the 10-year interest rate for the 20 largest economies (excluding India). This relationship is outright negative. The lower the growth potential, the lower the interest rate. Add Japan's absurd 2% inflation target, and it's evident what the Bank of Japan will do in the coming years. Interest rates must and will remain low. Compare this to the growth potential of the United States, and you'll understand why the interest rate differential will remain significant for a long time. The core condition for the Yen carry trade – a wide gap between interest rates – remains fully intact.

How So?

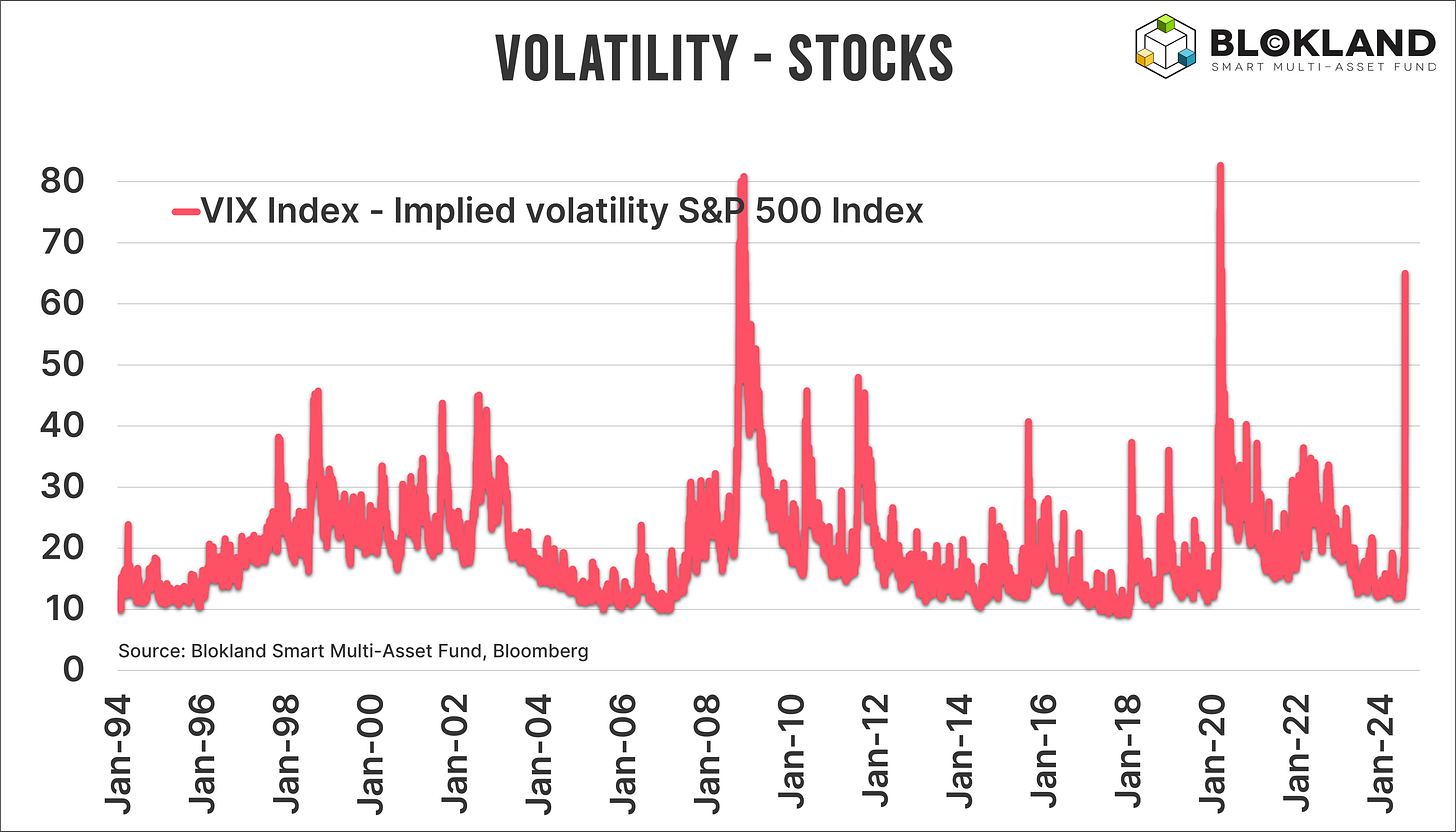

When the Nikkei Index closed 12% lower, the largest drop since Black Monday in October 1987, the U.S. economy was 100% not in a recession. Iran had not fired a missile – let's hope it stays that way – and there was no burst of the AI bubble or another Great Financial Crisis. Yet, the VIX exploded to a level only seen in 2008 and 2020.

How So? The answer is simple: leverage. Due to the increasing madness of central bank monetary policy, the size and reach of the carry trade have grown tremendously. No one really knows how big this trade is or where it ends. But let me put it this way: if it's nearly 100% certain that interest rates in Japan will remain at zero, some investors are likely using that borrowed money to buy more exotic assets than just U.S. Treasury bonds.

Volatility Risk

So, while it is evident that the Yen carry trade is not over but has temporarily scaled down due to sudden uncertainty, I cannot be happy about it. It leads to an even greater accumulation of carry trades and, hence, more volatility. After all, a 12% drop in Japanese stocks and a VIX of 65 don't quite match the current circumstances, do they?