Transform Your Investment Strategy with the 200-day Moving Average

the 200-day moving average is a very powerful indicator to enhance your investment performance

Welcome to another episode of The Market Routine - your expert guide to navigating the ever-evolving financial markets.

The latest rally has pushed stock markets above their 200-day moving average

After the latest rally, most major equity indices, like the S&P 500 Index, are trading above their 200-day moving average again. The reason this ‘sentiment indicator’ gets a lot of attention from investors and traders is pretty straightforward. US stocks tend to go up when trading above their 200-day moving average and go down when trading below that threshold. What’s more, an extremely simple and cost-efficient trading strategy based on the 200-day moving average would have saved you from the bulk of all major downturns and would have realized a return more than double that of a buy-and-hold strategy in US equities.

Good and Bad days

The chart below shows the average and median return on the S&P 500 Index on all trading days, on all days the index traded above its 200-day moving average, and on all days when it traded below that level since 1990. And the results are stunning. The average return on days the S&P 500 Index trades above its 200-day moving average equals 0.09%. To make that a bit more tangible, this translates into an annual return of +25%(!), assuming 260 trading days in a year. This compares to an average negative return on days the index trades below its 200-day moving average of -0.11%, or -25%(!) annualized. These averages are statistically significantly different from zero and each other. The differences for median returns are smaller but lead to the same conclusion.

So, historically the 200-day moving average has been a very strong indicator of ‘good’ and ‘bad’ days in the market. Most of the time, days on which the S&P 500 Index trades above or below the 200-day moving average come in ‘clusters,’ or groups. The S&P 500 has extended periods in which it trades above the moving average but also tends to trade for longer stints below it when a bear market occurs. This raises the question if the 200-day moving day average also says something about future returns.

Future Returns

The next chart reveals the average and median 1-month, 3-month, and 6-month future return on the S&P 500 Index on all trading days, on all days the index traded above its 200-day moving average, and on all days when it traded below that level since 1990. The future returns on all days and all days on which the S&P 500 Index trades above the 200-day moving average are very comparable. This is no surprise when you know that the S&P 500 Index trades above this level more than 70% of the time. But the future returns following days the index trades below the 200-day moving average are significantly lower. The purple oval highlights this. For example, the average future 6-month return on the S&P 500 Index has been 4.9% following days the index was trading above the 200-day moving average and 4.3% following all days. But after days on which the index traded below the 200-day moving average, the 6-month return averaged ‘just’ 2.6%. Again, the differences in median returns are smaller but confirm the overall pattern.

To conclude, the 200-day moving average is a very powerful indicator for US equities to include in your investment framework. But how does this look for other stock market indices? And how can you use the 200-day moving average to build a simple, but very profitable, investment strategy?

The NASDAQ

Let’s look at some other stock market indices first. The keep things concise, I repeat the same exercise for the other asset classes. Hence, I look at average (and median) returns on and after all days, days on which the index traded above its 200-day moving average, and days when it traded below the moving average.

First up is the NASDAQ Index. As the chart below reveals, the return difference between trading above (0.12%) and below (-0.13%) the 200-day moving average is bigger compared to the S&P 500 Index. This would translate to annualized returns of +37% when trading above and -28% when trading below the 200-day moving average.

Concerning 1-month, 3-month, and 6-month future returns, the pattern is similar to that of the S&P 500 Index returns. Especially the average future return on the NASDAQ Index has been relatively low following days it traded below its 200-day moving average. For example, the future average 6-month return was 4.46% against an average 6-month return of nearly 7.0% following days the NASDAQ traded above its 200-day moving average.

Global Equities - even better

Next is the MSCI World Index. Same story here. When the MSCI World Index trades above its 200-day moving average, the average return was positive (+0.08%) and above the average for all days but negative (-0.10%) and below the average for all days on days the index traded below moving average.

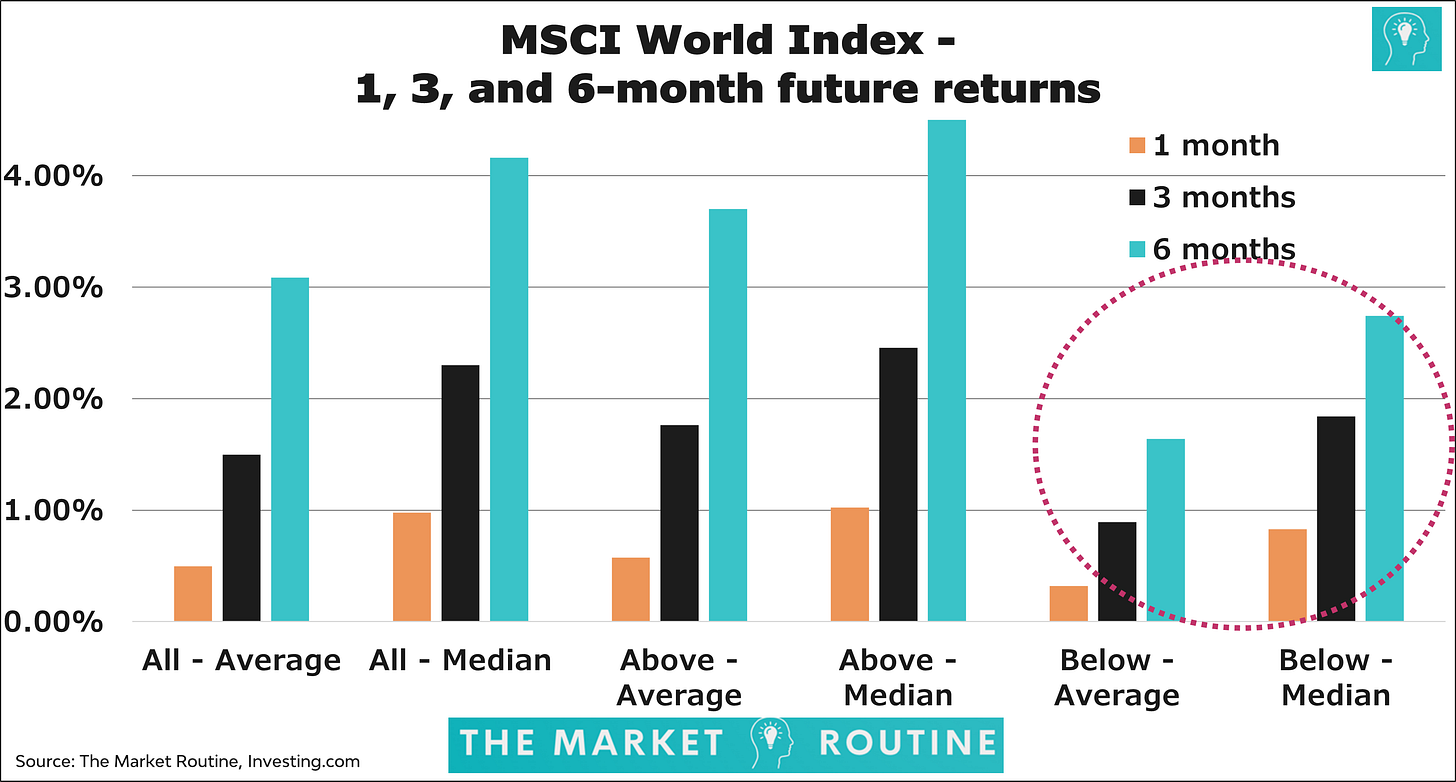

However, future returns look slightly different from the two US equity indices. First, the 1-month, 3-month, and 6-month future returns following days the MSCI World Index is trading above its 200-day moving average are now higher than the averages of all days. Second, not only the average but also the median returns following days the index trades below the 200-day moving average are significantly lower than the returns for the other groups. Both findings suggest even greater robustness of the 200-day moving average as an indicator that discriminates between ‘good’ and ‘bad’ days in international stock markets.

A highly profitable investment strategy

How can you use the 200-day moving average to enhance your returns? Simply get out of equities when they are trading below their 200-day moving average. Let me give you an example from a multi-asset perspective which, for me, is the holy grail of investing. The chart below shows the results of two investment strategies:

A buy-and-hold long the S&P 500 Index.

Long in the S&P 500 Index when it closed above its 200-day moving average and long in US Treasuries (all maturities) when the S&P 500 Index closed below its 200-day moving average.

By the way, the analysis starts in 1994 and not 1990, as Bloomberg provides daily data from then onwards.

Just look at that massive gap! The average realized annual return on the buy-and-hold S&P 500 Index strategy equals 6.8%. This compares to the 18.6%(!) average annual return of the 200-day moving average investment strategy.

Escaping the Bears

Why is the gap so colossal? This has to do with the clustering of days that the index trades above or below the 200-day moving average. During the really big downturns like 2000-2003 and 2007-2009, the S&P 500 Index traded below the 200-day moving average most of the time. For example, between September 2000 and January 2002, the S&P 500 Index did not trade above the 200-day moving average for a single day. During that period, the index fell almost 20%. The trading strategy would have pushed you into US Treasuries, which rose 11% during that period.

Between December 2007 and May 2009, the S&P 500 index never traded above its 200-day moving average. The index collapsed by 38% over that period, while US Treasuries rose 10%.

To conclude, the 200-day moving average is extremely valuable to incorporate into your framework because it helps you to survive all major drawdowns. And in a pretty straightforward way. It would remain highly profitable even if you allow for a threshold of, for example, five trading days before you implement this strategy. In addition, it would remain highly profitable even if you adjust your equity weight by ten percentage points based on the 200-day moving average.

Thank you for subscribing to The Market Routine

Jeroen.