On March 1, I wrote the following in a piece on rising bond yields and Commercial Bank Deposits:

‘banks are now pressured to lift the rates on their deposits. If they do, this will eat into their profit margin. If they do not, their reserves will dwindle, increasing the odds of a financial crisis’

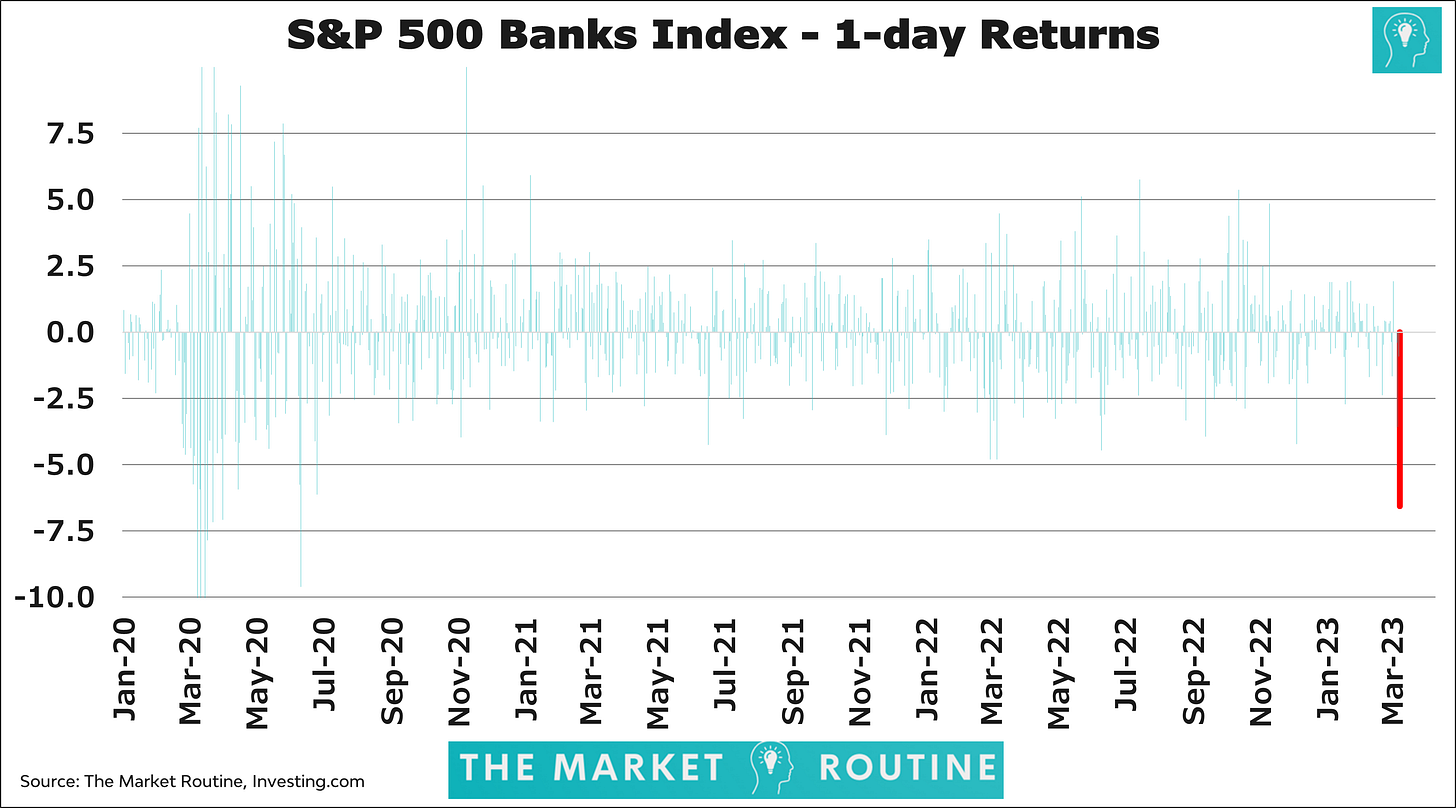

And after the biggest one-day decline in bank stocks since Covid, that crisis may unfold faster than anticipated. In this piece, I will explain what is happening, how the pieces fit together, and what implications recent developments have for markets and monetary policy.

Forget about Silvergate and Crypto

With the S&P 500 Banks Index down a whopping 6.6% on Thursday, the biggest decline since June 2000, this is not about some bank operating at the crossroads of crypto and traditional finance. This is about potential systemic bank risk.

The focus is now on SVB Financial, the holding company for Silicon Valley Bank, the biggest bank in Silicon Valley. According to Statista, Silicon Valley Bank ranked as the 14th largest US bank based on total assets in 2022.

Duration risk and balance sheet management

At the end of 2022, Silicon Valley Bank had just north of USD 160 billion in deposits on its books. Like many other banks, it put a large chunk of that money ‘to work.’ Banks can earn additional income by investing in assets with a higher yield than they pay on their deposits. Silicon Valley Bank did so with roughly USD 80 billion, which it invested predominantly in US Treasuries and mortgage-backed securities.

Many investors, perhaps also those running a bank’s investment book, tend to forget that while US Treasuries and mortgage-backed securities carry little credit or counterparty risk, they are not ‘risk free.’ Treasuries and the like are characterized by duration risk, or interest-rate sensitivity. While bond traders like to make duration a complex matter, the concept is extremely straightforward. When market yields rise, bond prices must drop to also reflect these higher yields and vice versa.

To get an idea of how much rising yields hurt the value of bonds, the chart below shows the performance of US Treasuries since the start of 2022 (left axis) and their yield to maturity (right axis). ‘Safe’ US Treasuries are down 12% as yields have increased from just above 1.0% to above 4.0%.

Hold to maturity

Now, if you aim to hold your Treasuries until maturity, all the fluctuations in the value of US Treasuries, including the 2022 bear market, are just noise.

When you hold a bond until maturity, you lock in the effective return, or yield to maturity, the minute you buy it. It’s when you are forced to sell, that big losses may occur.

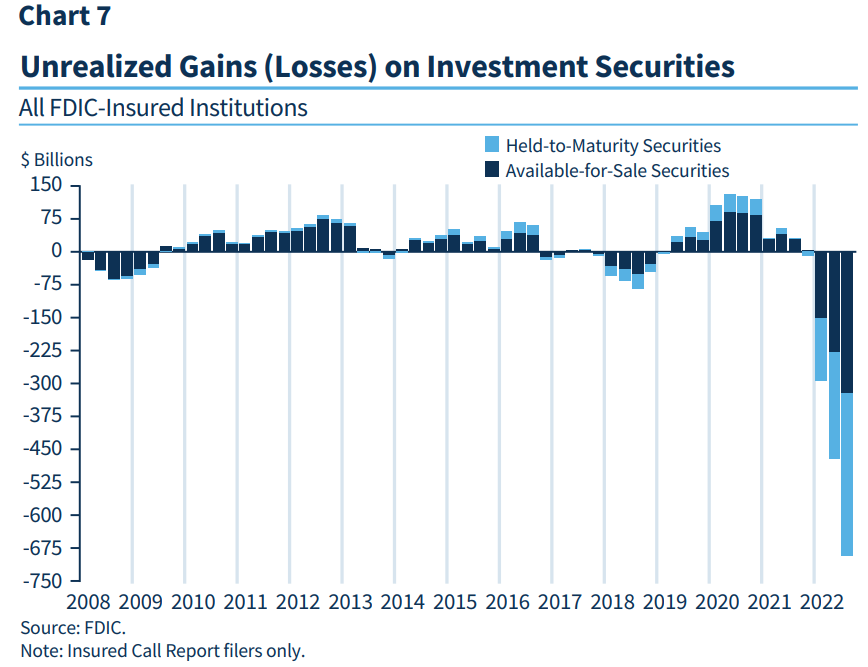

(Un)Realized losses

And this is exactly what banks are facing. The next chart from the Federal Deposit Insurance Corporation (FDIC) shows that US banks have about USD 700 billion in unrealized losses on their books. Most of that is related to the rapid rise in interest rates pushing down the value of their US Treasury and mortgage-backed security holdings. These losses will disappear only if banks do not have to sell their assets prematurely.

Commercial Bank Deposits

Enter deposits. Skyrocketing yields do not only impact the value of banks’ investment securities but also provide pressure on deposits. For example, Money Market Funds now offer more than 4% yield, while interest on bank deposits is nowhere near that level. As a result, bank deposits are declining, something which rarely happens. Banks are facing a dilemma. Pay higher interest rates on their deposits at the cost of profitability. Or don’t pay higher rates and risk a bank run.

This is exactly what Silicon Valley Bank is facing right now. Deposits are fleeing, not in the least because one of its biggest investors (Peter Thiel) has publicly ‘advised’ companies to withdraw their funds, meaning it has to realize the losses on its Treasury and mortgage-backed security investments. The risks of a Silicon Valley Bank bank run have exploded in recent days. Once this happens, there is no turning back most of the time.

Contagion

The reason the S&P 500 Banks Index fell 6.6% on Thursday is straightforward. With almost USD 700 billion in paper losses, there must be other ‘Silicon Valley Banks’ out there. When a big bank fails, contagion risk is never far away.

Connecting the Dots

Below are some key implications of what is happening now in the banking sector:

The odds of the Federal Reserve raising rates by 50 basis points if the banking issue is not solved between now and March 22 are slim. It would not be the first time a Fed tightening cycle is accompanied by a ‘credit event.’

Banks will become even more reluctant to increase lending. Especially when deposits are pressured. This means lending standards will tighten further from already strict levels. And as the chart below shows, there is a close relationship between lending standards and company defaults.

In turn, a rising number of defaults means high yield bond spreads, which remain very low, will go up, deteriorating the outlook for the asset class.

Finally, high yield bond spreads and equity markets are closely correlated. Hence, trouble for high yield bonds spells trouble for equities as well.

Investors should remain cautious in their positioning, holding below-average allocation toward risky assets like equities and high yield bonds. Should recent development end up in a credit event, the downside of these asset classes will be substantial.

Thank you for subscribing to The Market Routine.